Risks and Opportunities

By Kash Pashootan

Published March 9, 2023

Turning Lemons into Lemonade

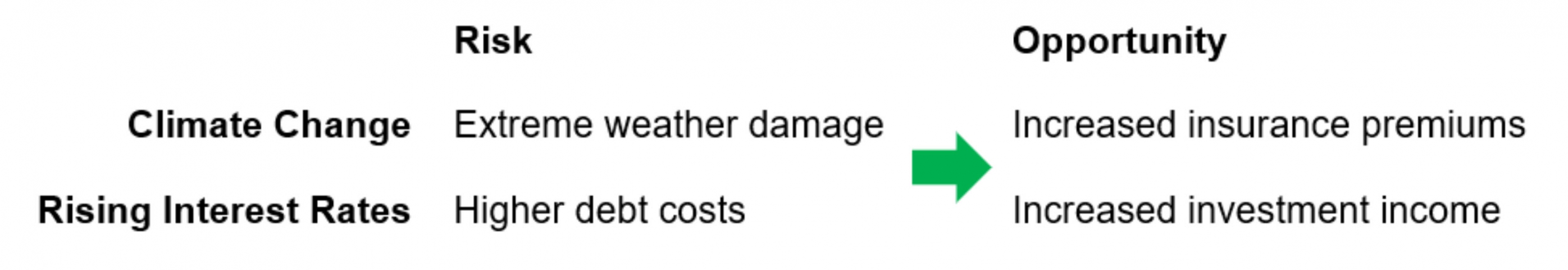

Change is constant. In a short period of time, central banks pivoted from the COVID induced policies of ultra-low interest rates to one of the fastest series of rate increases on record. Outside of the economy, the world is faced with ever changing realities and risks, with climate change top of mind for citizens and corporations alike. The risks of the current economic and climate realities are well known. Fortunately, where there is risk, there is also opportunity.

Fairfax Financial, one of the 20 largest global property and casualty insurers and reinsurers, directly benefits from the recent run up in interest rates as well as climate risks. We added Fairfax to the Momentum Mandate in December 2022, and shares are up 18% year to date.

Leveraging their armies of actuaries, underwriters, data scientists and other experts, Fairfax Financial selects risks and prices the insurance premiums accordingly. The reward is called underwriting profit, premiums collected less claims paid and other operating costs of the business. Premiums paid by property and business owners to Fairfax have tripled in the last seven years, resulting in over $21B in net premiums last year alone. 4.5% of this ever-growing pool of premiums accrues to the benefit of shareholders.

Rising interest rates are a burden to debtors and a blessing to creditors. Fairfax manages a $50B+ investment portfolio, including nearly $40B of cash, short-term, high-quality bonds and preferred shares. Until recently, this portfolio was restrained by structurally low interest rates, earning next to nothing. With the dramatic rise in interest rates this past year, Fairfax is poised to nearly triple its’ investment income, adding close to $1B to their bottom line. Analyst forecasts call for earnings per share to grow 143% this year.

Elevated interest rates and climate change will be a reality that society will need to navigate for the foreseeable future. As investment managers, our objective is to uncover opportunity, regardless of the macroeconomic backdrop. To put it differently, when the markets give you lemons, we search for the names that will in turn make lemonade.

We continue to lean into these uncertainties in the market, uncover new trends, and ultimately invest to create greater returns for your portfolios.

Stay Informed

THANK YOU FOR CONTACTING US.

We have received your message and will be in touch.

Ottawa

World Exchange Plaza

100 Queen Street, Suite 1060

Ottawa, ON

K1P 1J9

613.909.7334

info@firstavenuecounsel.com