Life Insurance - Protect and Enhance Your Estate

By First Avenue Investment Counsel

Published December 2, 2025

Permanent life insurance provides guaranteed lifelong coverage and the opportunity to accumulate cash value over time. Whether owned personally or by a corporation, permanent life insurance can provide not only financial security for your family’s future but also enhance your overall estate planning, increase liquidity and provide tax-saving opportunities.

Estate Preservation

Life insurance can help ensure your wealth will be protected and passed on to your beneficiaries. The death benefit is typically received tax free and can be used to pay for final expenses, such as funeral costs, estate taxes, probate fees, and other financial obligations that may erode the value of your estate.

Estate Equalization

Estate equalization may become essential in situations involving assets that are illiquid or have uneven values, or when one or more children may not be interested in inheriting specific assets, such as a cottage or a family business. Life insurance can provide liquidity needed to ensure that your beneficiaries receive a fair inheritance and are not forced to liquidate assets in a down cycle.

Enhancing Estate Value

Deposits into an exempt permanent life insurance policy in excess of the pure cost of insurance can grow tax-deferred. These extra funds can be used to fund future policy costs, buy additional insurance coverage and/or accumulate as cash value that can be accessed during life or paid out as a death benefit.

By reallocating excess funds from taxable investments into an exempt life insurance policy, you can potentially reduce your overall taxable investment income during your lifetime, reduce estate fees and taxes on death, and create a larger portion of tax-free assets available to your beneficiaries.

Joint Last-to-Die Insurance

Joint Last-to-Die (JLTD) life insurance is a type of permanent insurance that covers two individuals but only provides a death benefit when the last surviving insured passes away.

JLTD policies are usually less expensive than two individual policies, making them a cost-effective option, particularly for couples looking to protect or enhance their estate. These policies are usually set up to time the payout of life insurance death benefit when the estate tax liability is due.

Using JLTD insurance may be particularly beneficial for business owners, using after-tax corporate dollars to fund the annual premiums.

A life insurance policy owned by a private corporation is treated in a manner similar to a policy owned by an individual. The death benefit proceeds in excess of the adjusted cost base of the life insurance policy received by a corporate beneficiary can be passed on tax-free to the shareholders through the corporation’s capital dividend account (CDA).

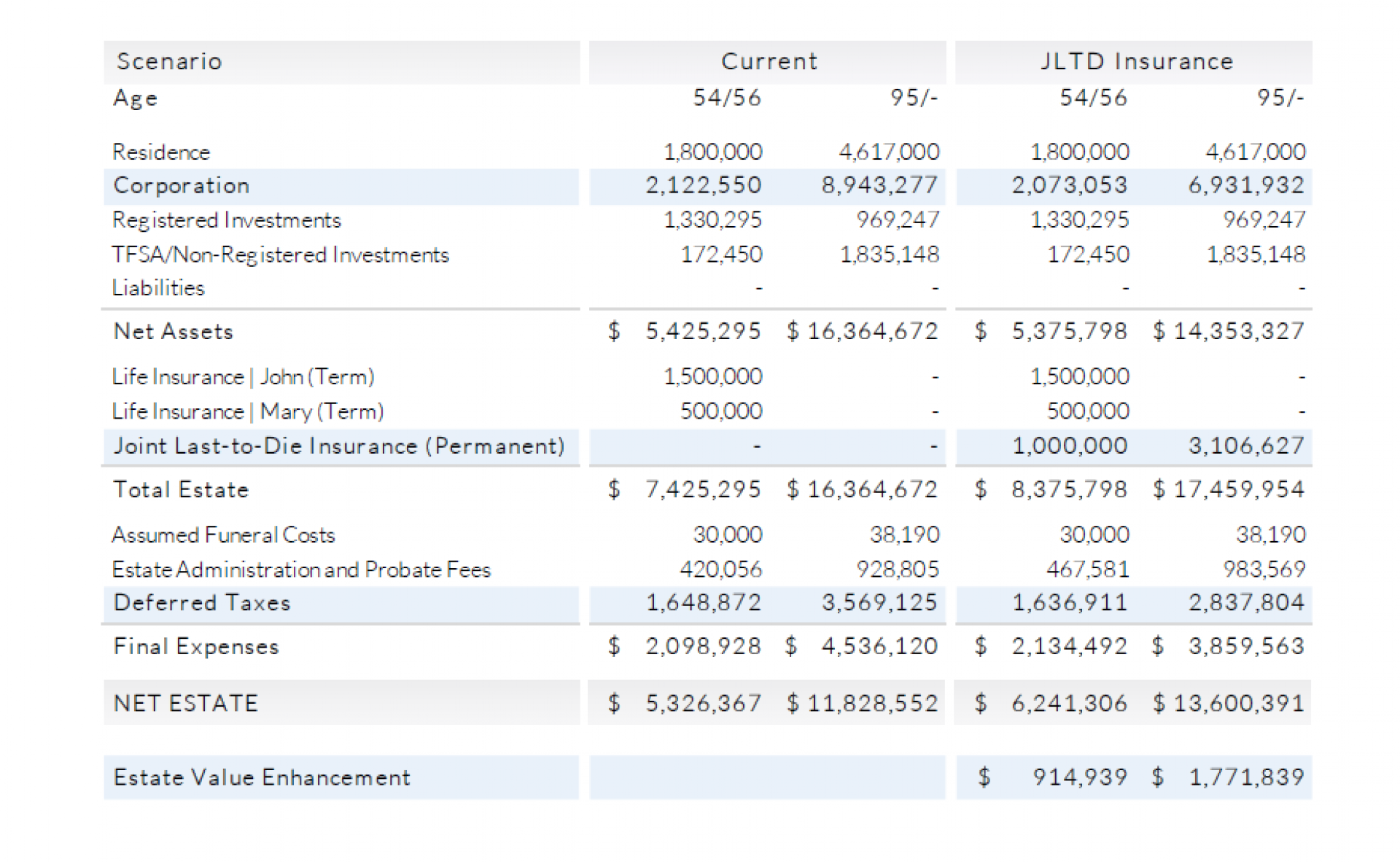

Let's Consider the Following Scenario

John (54) and Mary (56) are successful business owners with two children. They have saved and built a nest egg that will help them meet their after-tax income needs in retirement. They are looking for a tax-friendly solution to provide financial flexibility to their loved ones and reduce the impact of final expenses and income taxes on the value of their estate. All family members reside in Ontario.

We recommended they consider a joint-last-to-die whole life policy with an annual premium for the next 8 years of $54,845, funded from the corporate investment portfolio.

We can draw the following observations from the analysis:

i. Reduction in the value of the taxable assets residing in the corporate investment account.

ii. Increase in the value of the death benefit residing in the joint-last-to-die policy.

iii. Enhancement in the estate value at life expectancy.

Closing Thoughts

A comprehensive estate plan is a valuable step you can take to ensure your wishes are carried out exactly as intended. Including permanent life insurance as part of that plan adds an important layer of security, creates a tax-efficient transfer, and provides your loved ones with added control and financial flexibility.

Let’s discuss how we can help you build your estate plan and enhance your estate values1.

DISCLAIMER/ASSUMPTIONS

1 Life insurance offerings are available through our affiliate, First Avenue Advisory Inc.

The scenario presented in this planning article is for illustrative purposes only. Investment returns are based on hypothetical performance, assuming a balanced portfolio comprised of dividend paying equities and investment grade bonds generating a 5% average rate of return, compounded annually.

This data is not derived from the actual performance of any client account but rather from simulated investment results. The performance data should be understood as illustrative and not as a guarantee of future returns.

Joint-Last-to-Die Insurance Illustration

The joint-last-to-die whole life policy illustration values were obtained from a qualified insurance specialist, assuming a standard health

rating for John and Mary.

Estate Administration

Estate administration involves a lengthy process of notifying interested parties, collecting the deceased’s assets, creating an inventory, obtaining court approval, obtaining clearances from the Canada Revenue Agency and the eventual distribution of assets. This process takes time and often involves the work of accounting and legal professionals. In addition, an executor may optionally charge the estate for their services. We have used 5% of the gross value of the estate as the administration cost. Costs may vary depending on the complexity of the estate.

Probate Fees

Probate is the legal process that confirms the appointment of the executor and the validity of your Will. Probate fees in Ontario are some of the highest in Canada. For estates over $50,000, the fees are $15 for each $1,000 or part thereof by which the value of the estate exceeds $50,000. In our scenario, we have assumed that John and Mary have a dual Will structure in place. Probate fees vary from province to province.

Deferred Taxes

Upon death of the first spouse, assets transfer to the surviving spouse on a tax-deferred rollover basis. Provided that the real estate and non-registered investments are owned jointly, and proper spouse designations have been made on registered plans, there should be no tax liability at that time. When the second spouse passes away, all assets are deemed disposed of at fair market value and taxed accordingly on your final income tax return.

As it relates to the assets within a corporate structure, we have assumed the corporate wind-up and loss carryback strategy. The value presented is after corporate income tax and RDTOH refund, subject to personal income tax.

Stay Informed

THANK YOU FOR CONTACTING US.

We have received your message and will be in touch.

Ottawa

World Exchange Plaza

100 Queen Street, Suite 1060

Ottawa, ON

K1P 1J9

613.909.7334

info@firstavenuecounsel.com